By David Strickland, Vice President of Kenton Brothers

How the KB Advantage™ helped save the day.

As the Missouri Cannabis market hits full throttle, many of the early adopters are coming on line. Kenton Brothers Systems for Security is honored to be partnered with Vertical Enterprises, led by CEO Chris McHugh. Vertical Enterprises grows and manufactures Grade A flower and extracts in St Joseph Missouri.

As the Missouri Cannabis market hits full throttle, many of the early adopters are coming on line. Kenton Brothers Systems for Security is honored to be partnered with Vertical Enterprises, led by CEO Chris McHugh. Vertical Enterprises grows and manufactures Grade A flower and extracts in St Joseph Missouri.

Vertical’s state of the art facility employs the most current technology to insure purity and yield. We are most impressed by Vertical’s attention to detail when it come to the high standards they’ve brought to the Missouri Cannabis industry.

McHugh said they will provide patients the best quality indoor marijuana grown without the energy ravenous methods traditionally used for growing indoor marijuana.

Instead of using high-pressure sodium lights and retrofitting a warehouse with 30’ tall ceilings that have to be climate controlled, our facility will be 100 percent purpose-built and LED. We care about marijuana, but we also care about the planet we live on.

Kenton Brothers Systems for Security partnered with Vertical to create a holistic security plan for the grow site as well as the dispensary locations. The goal was to keep the same attention to detail and quality as seen throughout the Vertical platform. Vertical recognized Kenton Brothers’ quality of installation and the process we take to create solutions that are not only highly secure but take into account the regulations and oversight required by the State of Missouri.

Kenton Brothers Systems for Security partnered with Vertical to create a holistic security plan for the grow site as well as the dispensary locations. The goal was to keep the same attention to detail and quality as seen throughout the Vertical platform. Vertical recognized Kenton Brothers’ quality of installation and the process we take to create solutions that are not only highly secure but take into account the regulations and oversight required by the State of Missouri.

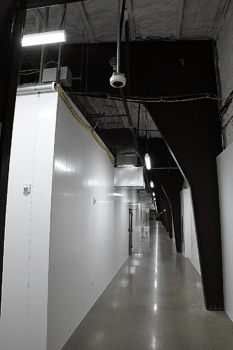

Kenton Brothers would design and integrate Access Control, IP Video Surveillance and Intrusion Detection into the Vertical Manufacturing and Grow site as well as the Dispensaries.

Kenton Brothers selected Gallagher Access control, a worldwide leader in Cannabis Security, and Milestone X Protect Digital Video Management System as the basis for the security solution. Based on Vertical’s feedback and high standards, we knew this would be the best fit for their needs.

With this solution comes the ability to manage multiple locations through one administrator and allow the State of Missouri the oversight it has regulated into the industry. It has the capability to tie into power and environmental sensors as well as track key personnel certifications and clearances thereby automating checks and balances in the spaces.

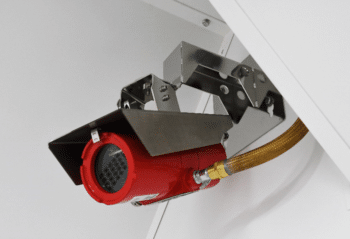

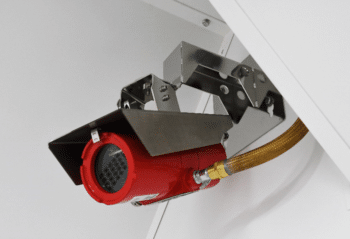

Explosion proof?

One of the unique situations that came up during the integration phase was an unforeseen requirement placed on Vertical by the State to have cameras installed in an extraction booth. The unique thing about this requirement was that the cameras had to be explosion proof as the extractor uses a combustible gas as part of the process.

One of the unique situations that came up during the integration phase was an unforeseen requirement placed on Vertical by the State to have cameras installed in an extraction booth. The unique thing about this requirement was that the cameras had to be explosion proof as the extractor uses a combustible gas as part of the process.

For this to happen, two explosion proof cameras had to be installed with only two weeks left for final inspection. Chris McHugh called Kenton Brothers and asked, “What do we need to do to make it happen?” Our answer was, “We are on it.” We needed to make some calls fast because these cameras usually take six to eight weeks to receive.

Through Kenton Brothers relationships, we were able to find two cameras and mounts that met the criteria of explosion proof on a shelf in Chicago. They had been ordered for a project that was cancelled and were available immediately. The cameras and mounts were installed in time for final inspection.

The KB Advantage™

Kenton Brothers utilizes the KB Advantage™ process to walk customers such as Vertical Enterprises through the systems for security Integration process by taking the time to clearly understand their needs, creating the right solution and then creating the plan for installation and training. This allows us the time, energy and attitude to manage the surprises in every project. In this case we are able to leverage our nationwide relationships to solve our customers problem in record speed.

Kenton Brothers utilizes the KB Advantage™ process to walk customers such as Vertical Enterprises through the systems for security Integration process by taking the time to clearly understand their needs, creating the right solution and then creating the plan for installation and training. This allows us the time, energy and attitude to manage the surprises in every project. In this case we are able to leverage our nationwide relationships to solve our customers problem in record speed.

It is a lot of fun to see projects of this size and scope come to fruition and to see our customers realize their goal of creating a world class manufacturing facility.

We love what we do at Kenton Brothers.

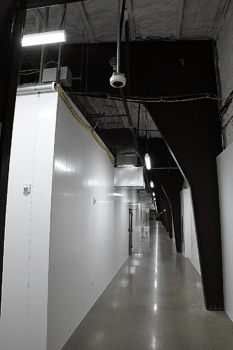

Our Mission is to protect People, Property and Possessions. Our Project manager Eric Searcy and our foreman Jeremy Shinneman asked that we share the following images as a testament to their craftmanship. They did a fantastic job delivering the KB Advantage™.

The new solution begins with a card access control system by Gallagher. This system is tied to a custom programmable logic controller for general jail control, including lighting and water control. We also implement a Milestone commercial video surveillance system with Axis cameras and intercoms for verbal communication. All systems operate over the detention centers network.

The new solution begins with a card access control system by Gallagher. This system is tied to a custom programmable logic controller for general jail control, including lighting and water control. We also implement a Milestone commercial video surveillance system with Axis cameras and intercoms for verbal communication. All systems operate over the detention centers network.

As the Missouri Cannabis market hits full throttle, many of the early adopters are coming on line. Kenton Brothers Systems for Security is honored to be partnered with Vertical Enterprises, led by CEO

As the Missouri Cannabis market hits full throttle, many of the early adopters are coming on line. Kenton Brothers Systems for Security is honored to be partnered with Vertical Enterprises, led by CEO  Kenton Brothers Systems for Security partnered with Vertical to create a holistic security plan for the grow site as well as the dispensary locations. The goal was to keep the same attention to detail and quality as seen throughout the Vertical platform. Vertical recognized Kenton Brothers’ quality of installation and the process we take to create solutions that are not only highly secure but take into account the regulations and oversight required by the State of Missouri.

Kenton Brothers Systems for Security partnered with Vertical to create a holistic security plan for the grow site as well as the dispensary locations. The goal was to keep the same attention to detail and quality as seen throughout the Vertical platform. Vertical recognized Kenton Brothers’ quality of installation and the process we take to create solutions that are not only highly secure but take into account the regulations and oversight required by the State of Missouri. One of the unique situations that came up during the integration phase was an unforeseen requirement placed on Vertical by the State to have cameras installed in an extraction booth. The unique thing about this requirement was that the cameras had to be explosion proof as the extractor uses a combustible gas as part of the process.

One of the unique situations that came up during the integration phase was an unforeseen requirement placed on Vertical by the State to have cameras installed in an extraction booth. The unique thing about this requirement was that the cameras had to be explosion proof as the extractor uses a combustible gas as part of the process. Kenton Brothers utilizes the KB Advantage™ process to walk customers such as Vertical Enterprises through the systems for security Integration process by taking the time to clearly understand their needs, creating the right solution and then creating the plan for installation and training. This allows us the time, energy and attitude to manage the surprises in every project. In this case we are able to leverage our nationwide relationships to solve our customers problem in record speed.

Kenton Brothers utilizes the KB Advantage™ process to walk customers such as Vertical Enterprises through the systems for security Integration process by taking the time to clearly understand their needs, creating the right solution and then creating the plan for installation and training. This allows us the time, energy and attitude to manage the surprises in every project. In this case we are able to leverage our nationwide relationships to solve our customers problem in record speed.

You see it in the headlines all the time. “ABC” Company was hacked today. The extent of the breach is still undetermined. They have begun notifying customers that have been compromised. In just the last year alone, hacks of banking and financial institutions are up 238%. Forbes magazine reports that on one day in 2020 there was over 2,500 attacks.

You see it in the headlines all the time. “ABC” Company was hacked today. The extent of the breach is still undetermined. They have begun notifying customers that have been compromised. In just the last year alone, hacks of banking and financial institutions are up 238%. Forbes magazine reports that on one day in 2020 there was over 2,500 attacks. Here are some tips for defending your systems:

Here are some tips for defending your systems:

The timeline for this project was a total of 15 weeks. This meant we would be doing installations at roughly 43 sites per week. One of the requirements of this project was to meet a federally mandated deadline. This required us to plan the best routes possible to ensure our technicians were as efficient as possible.

The timeline for this project was a total of 15 weeks. This meant we would be doing installations at roughly 43 sites per week. One of the requirements of this project was to meet a federally mandated deadline. This required us to plan the best routes possible to ensure our technicians were as efficient as possible.